Tax Jurisdiction

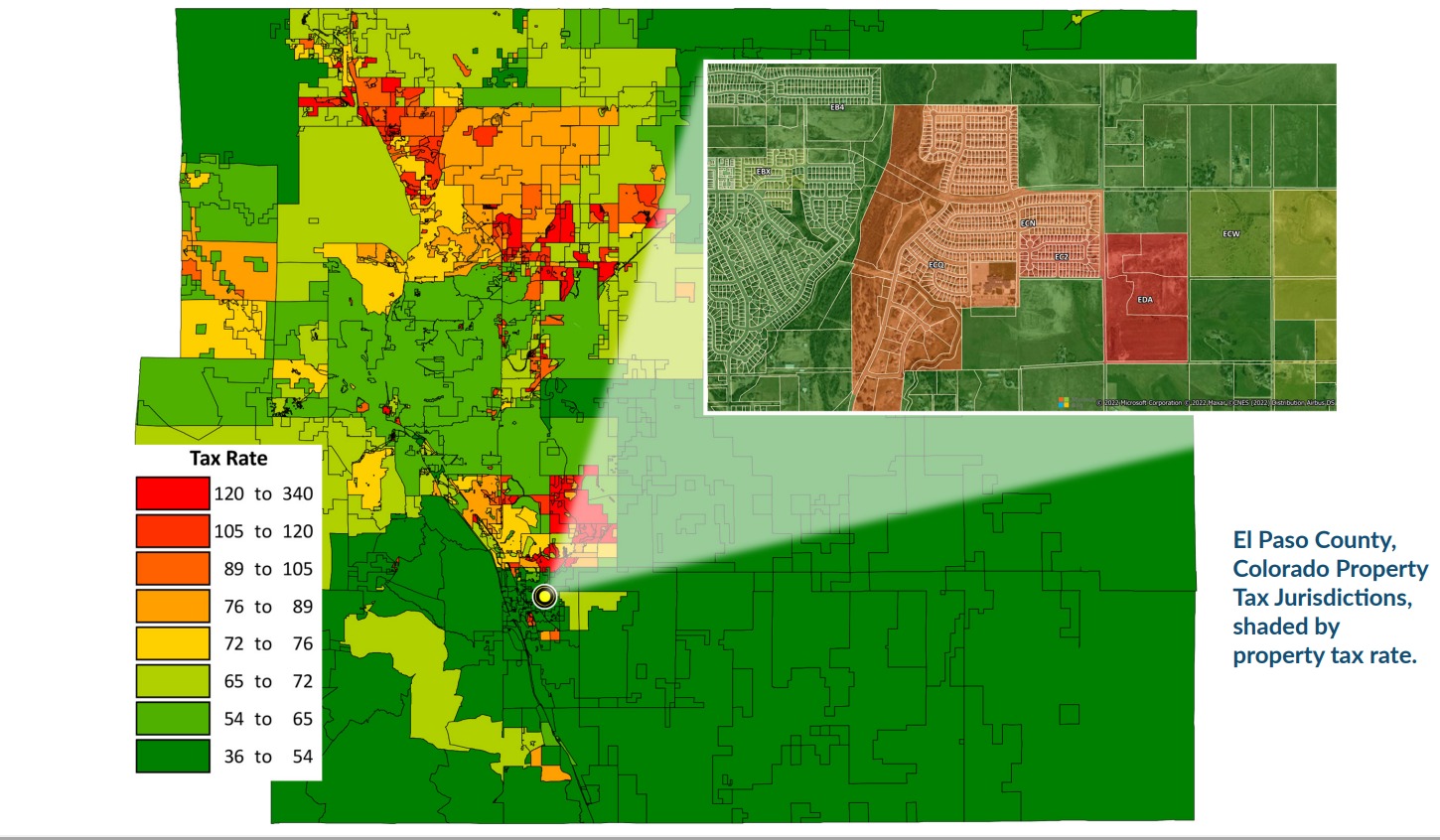

- Property Tax Compliance – Accurately relate assets to their proper jurisdictions for filing and billing purposes.

- Tax Liability Estimations – Keep current with tax jurisdiction changes and tax rates for capital expansion projects and tax planning purposes.

- Risk Mitigation – Accurately report assets to avoid lost revenue due to penalties, interest, and overstating property tax liabilities.

- Time Management – Reduce or eliminate labor intensive process of building and maintaining tax jurisdiction data and boundaries.

Get Expert Advice on Tax Jurisdiction

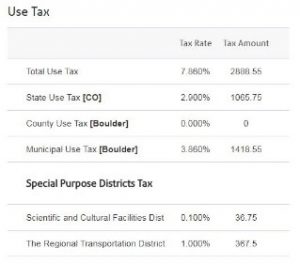

Tax Jurisdiction: Given a location, return the tax information.

- Locate Sales Tax and General Use Tax Rates

- Locate Insurance Premium Districts

- Locate Payroll Tax Districts

- Locate Property Tax Districts

- Locate Special Purpose Tax Districts

- Reverse Lookup using Tax Jurisdiction

Things to consider:

- Nearly 30% of ZIP codes in the US are in conflict with municipal, county, and state boundaries

- There are almost 4,800 changes to municipal boundaries every year

- Approximately 25% of all 19,000 incorporated municipalities in the U.S. change their boundaries each year.

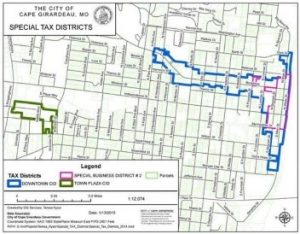

Special districts do not conform to other boundaries and can:

Special districts do not conform to other boundaries and can:

- Cross ZIP codes

- Exist within a portion of a ZIP code

- Consist of multiple, disconnected regions

- Change frequently

- Overlap

- Buffering capabilities allow you define areas that are close to tax jurisdictions. Circles, polygons and corridors (buffering lines) are supported.

These services are at present, US-only. Separate from this service, some of the boundary data can be licensed.

IMPORTANCE OF GEOCODING: Keep in mind that all calculations such as these depend on a quality geocode. These services will provide accurate answers for whatever is inputted, but if the coordinates aren’t right to begin with, the answers may not be right. Geocode coordinates from consumer systems like Google™ or Bing™ are often wrong enough that you would be getting wrong answers. We recommend using quality geocoding. See Geocoding above.

Web Service

Assigns jurisdictions and rates for asset addresses or geographic coordinates.

- Assigns jurisdictions based on latitude/longitude

or address - Standardizes addresses

- Uses county supplied tax rolls, parcel-level data

and geographic boundaries to accurately assign

jurisdictions, including special tax districts - Supports both deliverable and non-deliverable

United States Postal Service addresses

GIS & Attribute Data

Detailed information for taxing jurisdictions.

- Geographic Information System (GIS) boundaries

and state and local names, codes and attributes for

180,000+ taxing jurisdictions to allocate and report

distributed and situs assets. For ESRI®, MapInfo®, your own web services, etc… - Current tax rates for estimating and planning purposes

Tax Information for Excel

An add-in component to Microsoft Excel that delivers up to-date property tax data.

- Conveniently calls a Web Service from

within Excel - Automatic address correction and jurisdiction

assignments; quickly processes up to 2,000 asset

addresses per minute - Links to Google Maps, Bing, MapQuest to make

researching and resolving the address quick and easy

Batch Service

Standardize and assign tax jurisdictions for a batch file of addresses.

- Designed for and compatible with CSC’s (Tax Compliance, Inc.) PTMS software

- Reduces workload and improves efficiency by letting

our web service process the address data - No software to install; all you need is a web browser

You are on the Tax Jurisdiction Services Page in the Software-as-a-Service (SaaS) Section….