You are on the Tax Jurisdiction Services Page in the Software-as-a-Service (SaaS) Section….

[dipi_button_grid flex_direction=”row” _builder_version=”4.16″ _module_preset=”default” text_style_font=”Molengo|||||on|||” text_style_text_align=”center” text_style_font_size=”14px” background_color=”rgba(0,0,0,0)” transform_translate=”0px|-25px” transform_translate_linked=”off” max_height=”306px” custom_margin=”||||false|false” custom_padding=”||||false|false” animation_style=”fade” animation_duration=”400ms” border_color_all=”#edf000″ saved_tabs=”all” locked=”off” global_colors_info=”{}”][dipi_button_grid_child button_id=”SaaS Overview” button_text=”SaaS Overview” button_link=”https://spatialpoint.com/saas-ondemand/” _builder_version=”4.16″ _module_preset=”default” text_style_font=”Molengo|||||on|||” text_style_font_size=”26px” background_color=”rgba(0,0,0,0)” background_enable_color=”on” custom_button=”on” button_text_color=”#ffffff” button_bg_color=”#e02b20″ button_border_color=”#d6d6d6″ button_border_radius=”11px” button_font=”Roboto||||||||” button_use_icon=”on” button_icon=”%%24%%” button_icon_color=”#ffffff” button_on_hover=”on” custom_margin=”|0px|||false|false” custom_padding=”||||false|false” border_width_all=”1px” border_color_all=”rgba(0,0,0,0)” box_shadow_style_button=”preset1″ global_colors_info=”{}”][/dipi_button_grid_child][dipi_button_grid_child button_id=”Geocoding” button_text=”Geocoding” button_link=”https://spatialpoint.com/1-geocoding/” _builder_version=”4.16″ _module_preset=”default” text_style_font=”Molengo|||||on|||” text_style_font_size=”26px” background_color=”rgba(0,0,0,0)” background_enable_color=”on” custom_button=”on” button_text_color=”#ffffff” button_bg_color=”#e02b20″ button_border_color=”#d6d6d6″ button_border_radius=”11px” button_font=”Roboto||||||||” button_use_icon=”on” button_icon=”%%24%%” button_icon_color=”#ffffff” button_on_hover=”on” custom_margin=”|0px|||false|false” custom_padding=”||||false|false” border_width_all=”1px” border_color_all=”rgba(0,0,0,0)” box_shadow_style_button=”preset1″ global_colors_info=”{}”][/dipi_button_grid_child][dipi_button_grid_child button_id=”AddressVal” button_text=”Address Validation & Correction” button_link=”https://spatialpoint.com/address-validation/” _builder_version=”4.16″ _module_preset=”default” text_style_font=”Molengo|||||on|||” text_style_font_size=”26px” background_color=”rgba(0,0,0,0)” background_enable_color=”on” custom_button=”on” button_text_color=”#ffffff” button_bg_color=”#e02b20″ button_border_color=”#d6d6d6″ button_border_radius=”11px” button_font=”Roboto||||||||” button_use_icon=”on” button_icon=”%%24%%” button_icon_color=”#ffffff” button_on_hover=”on” custom_margin=”|0px|||false|false” custom_padding=”||||false|false” border_width_all=”1px” border_color_all=”rgba(0,0,0,0)” box_shadow_style_button=”preset1″ global_colors_info=”{}”][/dipi_button_grid_child][dipi_button_grid_child button_id=”ReverseGeocoding” button_text=”Reverse Geocoding” button_link=”https://spatialpoint.com/3-reverse-geocoding/” _builder_version=”4.16″ _module_preset=”default” text_style_font=”Molengo|||||on|||” text_style_font_size=”26px” background_color=”rgba(0,0,0,0)” background_enable_color=”on” custom_button=”on” button_text_color=”#ffffff” button_bg_color=”#e02b20″ button_border_color=”#d6d6d6″ button_border_radius=”11px” button_font=”Roboto||||||||” button_use_icon=”on” button_icon=”%%24%%” button_icon_color=”#ffffff” button_on_hover=”on” custom_margin=”|0px|||false|false” custom_padding=”||||false|false” border_width_all=”1px” border_color_all=”rgba(0,0,0,0)” box_shadow_style_button=”preset1″ global_colors_info=”{}”][/dipi_button_grid_child][dipi_button_grid_child button_id=”Street-Level Routing” button_text=”Street-Level Routing” button_link=”https://spatialpoint.com/4-street-level-routing/” _builder_version=”4.16″ _module_preset=”default” text_style_font=”Molengo|||||on|||” text_style_font_size=”26px” background_color=”rgba(0,0,0,0)” background_enable_color=”on” custom_button=”on” button_text_color=”#ffffff” button_bg_color=”#e02b20″ button_border_color=”#d6d6d6″ button_border_radius=”11px” button_font=”Roboto||||||||” button_use_icon=”on” button_icon=”%%24%%” button_icon_color=”#ffffff” button_on_hover=”on” custom_margin=”|0px|||false|false” custom_padding=”||||false|false” border_width_all=”1px” border_color_all=”rgba(0,0,0,0)” box_shadow_style_button=”preset1″ global_colors_info=”{}”][/dipi_button_grid_child][dipi_button_grid_child button_id=”InsuranceRisk” button_text=”Insurance Risk Services” button_link=”https://spatialpoint.com/insurance-risk-services/” _builder_version=”4.16″ _module_preset=”default” text_style_font=”Molengo|||||on|||” text_style_font_size=”26px” background_color=”rgba(0,0,0,0)” background_enable_color=”on” custom_button=”on” button_text_color=”#ffffff” button_bg_color=”#e02b20″ button_border_color=”#d6d6d6″ button_border_radius=”11px” button_font=”Roboto||||||||” button_use_icon=”on” button_icon=”%%24%%” button_icon_color=”#ffffff” button_on_hover=”on” custom_margin=”|0px|||false|false” custom_padding=”||||false|false” border_width_all=”1px” border_color_all=”rgba(0,0,0,0)” box_shadow_style_button=”preset1″ global_colors_info=”{}”][/dipi_button_grid_child][dipi_button_grid_child button_id=”PSAP911″ button_text=”911/E911/PSAP” button_link=”https://spatialpoint.com/6-911-e911-psap/” _builder_version=”4.16″ _module_preset=”default” text_style_font=”Molengo|||||on|||” text_style_font_size=”26px” background_color=”rgba(0,0,0,0)” background_enable_color=”on” custom_button=”on” button_text_color=”#ffffff” button_bg_color=”#e02b20″ button_border_color=”#d6d6d6″ button_border_radius=”11px” button_font=”Roboto||||||||” button_use_icon=”on” button_icon=”%%24%%” button_icon_color=”#ffffff” button_on_hover=”on” custom_margin=”|0px|||false|false” custom_padding=”||||false|false” border_width_all=”1px” border_color_all=”rgba(0,0,0,0)” box_shadow_style_button=”preset1″ global_colors_info=”{}”][/dipi_button_grid_child][dipi_button_grid_child button_id=”Tax Jurisdiction ” button_text=”Tax Jurisdiction ” button_link=”https://spatialpoint.com/7-tax-jurisdiction/” _builder_version=”4.16″ _module_preset=”default” text_style_font=”Molengo|||||on|||” text_style_font_size=”26px” background_color=”rgba(0,0,0,0)” background_enable_color=”on” custom_button=”on” button_text_color=”#ffffff” button_bg_color=”#fc9569″ button_border_color=”#d6d6d6″ button_border_radius=”11px” button_font=”Roboto||||||||” button_use_icon=”on” button_icon=”%%24%%” button_icon_color=”#ffffff” button_on_hover=”on” custom_margin=”|0px|||false|false” custom_padding=”||||false|false” border_width_all=”1px” border_color_all=”rgba(0,0,0,0)” box_shadow_style_button=”preset1″ global_colors_info=”{}”][/dipi_button_grid_child][dipi_button_grid_child button_id=”Specialty” button_text=”Specialty” button_link=”https://spatialpoint.com/8-specialty/” _builder_version=”4.16″ _module_preset=”default” text_style_font=”Molengo|||||on|||” text_style_font_size=”26px” background_color=”rgba(0,0,0,0)” background_enable_color=”on” custom_button=”on” button_text_color=”#ffffff” button_bg_color=”#e02b20″ button_border_color=”#d6d6d6″ button_border_radius=”11px” button_font=”Roboto||||||||” button_use_icon=”on” button_icon=”%%24%%” button_icon_color=”#ffffff” button_on_hover=”on” custom_margin=”|0px|||false|false” custom_padding=”||||false|false” border_width_all=”1px” border_color_all=”rgba(0,0,0,0)” box_shadow_style_button=”preset1″ global_colors_info=”{}”][/dipi_button_grid_child][/dipi_button_grid]

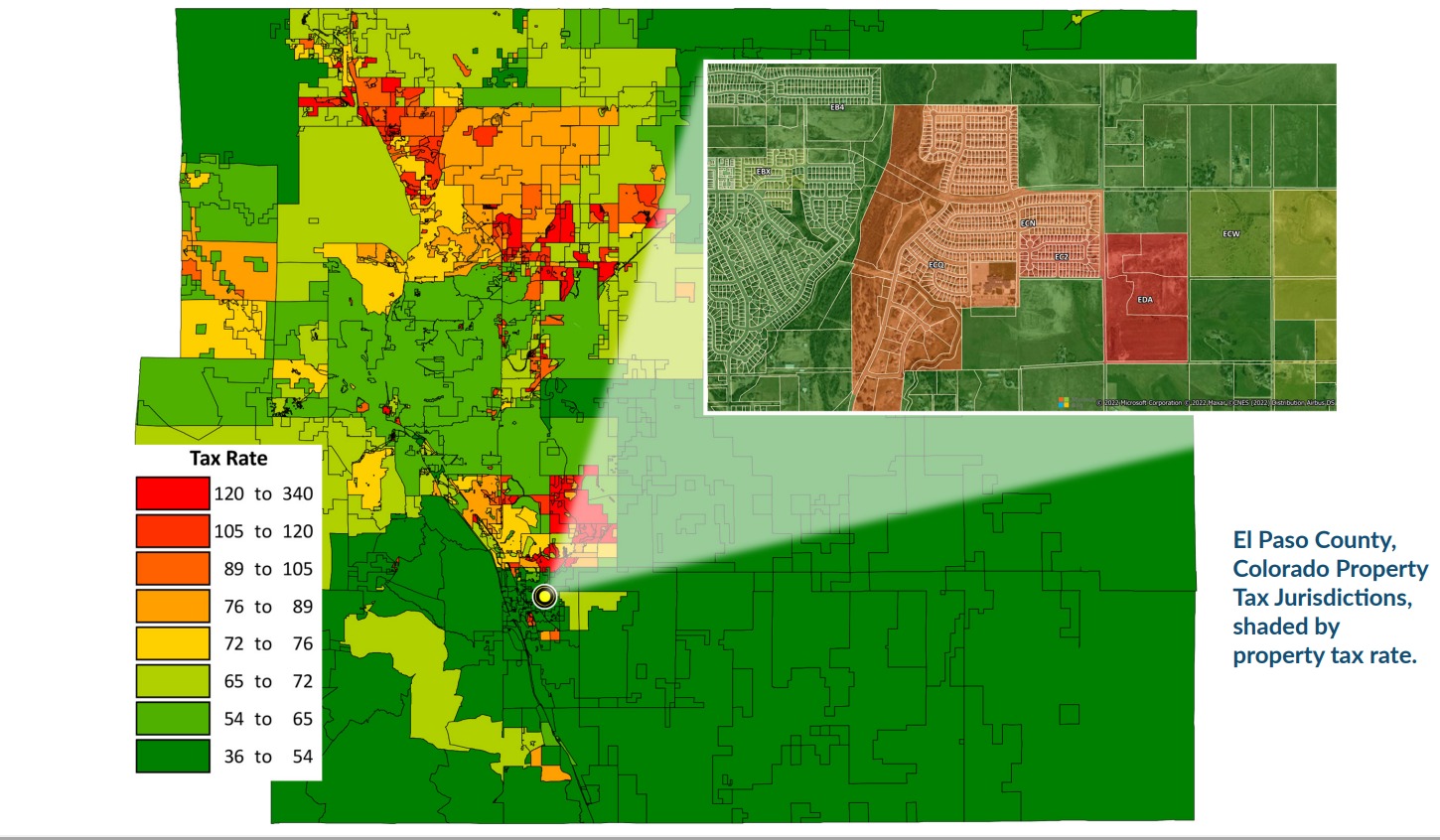

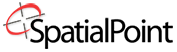

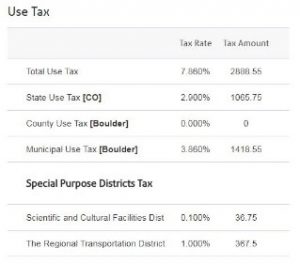

Special districts do not conform to other boundaries and can:

Special districts do not conform to other boundaries and can: