Property and Casualty Insurance Overview

Insurance is a promise to policyholders. It says, when something goes wrong, we’ll be there to help. But you can’t make that promise to everyone and stay profitable. That’s where data makes a difference.

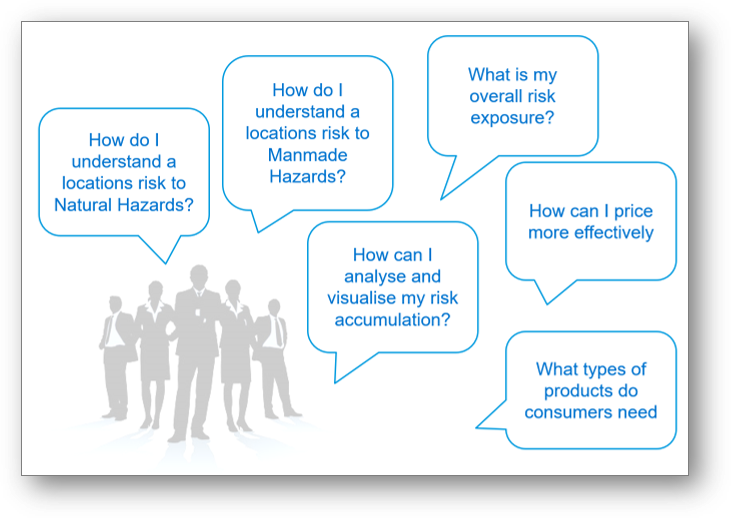

A single view of risk makes a difference.

…and everything you do depends on precise data.

Current and more accurate datasets to deliver today’s must-have insights.

Detect risk that others miss

- Understand natural hazards risk

- Pinpoint pockets of opportunity

Provide accurate, competitive pricing

-

Price based on a more accurate risk assessment

- Manage state filing requirements

Visualize total portfolio exposure

-

Enhance financial risk models

-

Determine PML

Understand which products consumers need

- Improve product design and pricing

For example, what are the issues with buildings with more than one address?

Quality geocoding and detailed information about the result are important in insurance:

Build a data-centric insurance company:

Insurance Risk Services

Click on the image or here to see our Insurance Risk Services Page (opens in a new tab) or click on a Quick Link below:

1. Wildfire Risk, Property Fire Risk

2. Flood

3. Earth Risks

4. Distance to Coastline

5 Historical Weather

6. Dynamic Weather

7. Crime Data